The Hidden Costs of Legacy Payment Infrastructure: A 2025 Perspective

Modern FinTech companies are still building on payment infrastructure designed for a different age. Having guided dozens of companies through modernization, one thing becomes clear: the true cost of legacy systems isn't on your balance sheet.

Organizations don't realize they're sitting on a payment infrastructure time bomb until it explodes. By then, the cost of inaction has already compounded.

The Real Price of Technical Debt in Payment Systems

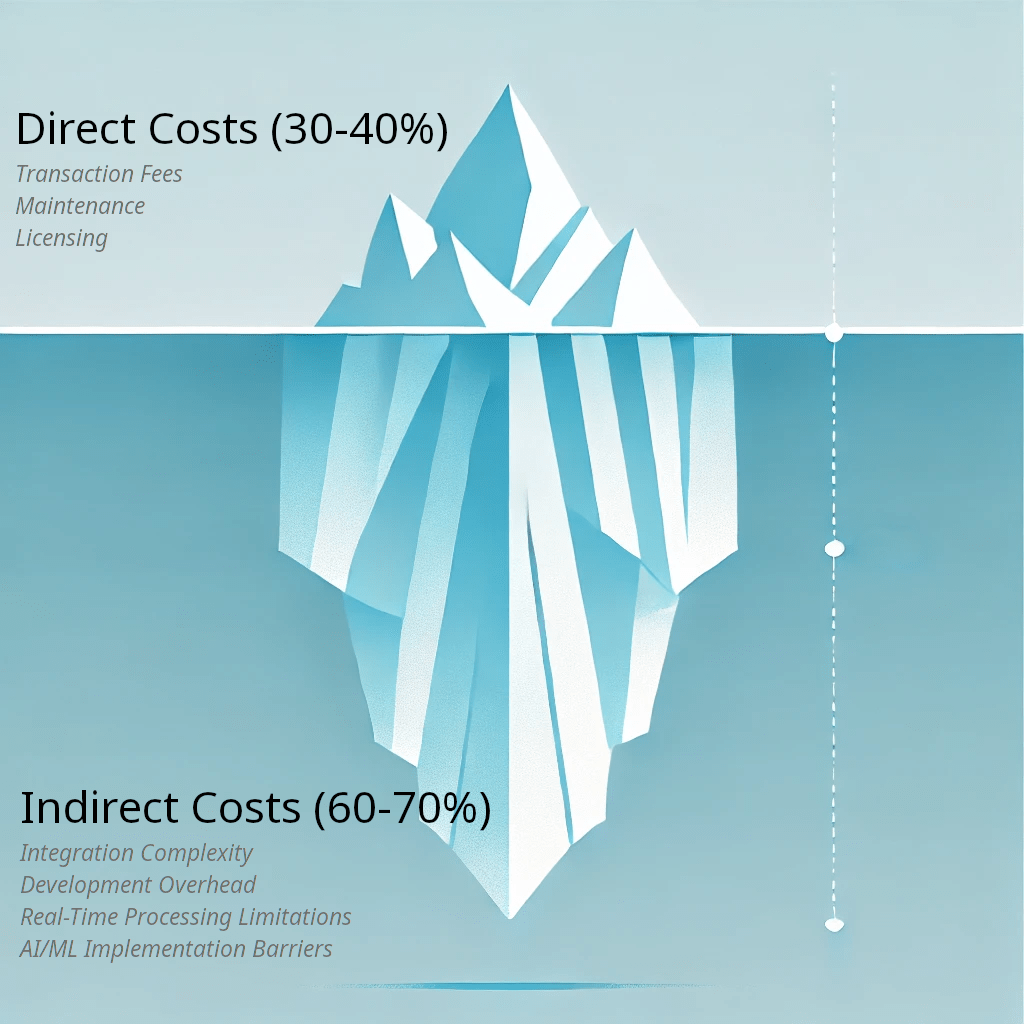

When evaluating payment infrastructure, most organizations focus on direct costs: transaction fees, maintenance contracts, and licensing. However, our analysis across dozens of FinTech implementations reveals that indirect costs typically account for 60-70% of total infrastructure expenses.

Our analysis shows that indirect costs typically account for 60-70% of total infrastructure expenses in legacy payment systems.1. Integration Complexity and Development Overhead

Legacy payment systems often require complex integration patterns that can double or triple your development timeline. Modern developers, trained in RESTful APIs and event-driven architectures, must navigate outdated protocols and synchronous workflows.

2. Real-Time Processing Limitations

Traditional batch-based processing models are increasingly becoming a competitive liability. Our recent client work has shown that companies with real-time payment capabilities experience 35% higher customer engagement.

Companies with real-time payment capabilities experience 35% higher customer engagement compared to those using batch processing.The AI Readiness Factor

Perhaps the most significant hidden cost is the inability to effectively implement AI/ML solutions. Legacy payment infrastructure typically lacks the fundamental requirements for modern AI implementation:

You can't bolt AI onto a legacy payment system any more than you can turn a steam engine into a Tesla. The foundations are fundamentally different.

Strategic Modernization: A Practical Framework

Rather than suggesting a complete system overhaul, we advocate for a strategic modernization approach. The key is starting with a clear understanding of your current state and a strategic roadmap for evolution.

API Layer Modernization Create a modern API facade over legacy systems, enabling gradual modernization while maintaining operations.

Event Stream Implementation Implement event streaming for critical transaction data, enabling real-time processing capabilities without replacing core systems.

Modular Replacement Strategy Systematically replace legacy components based on business impact and technical risk.

Looking Ahead: 2025 and Beyond

The financial services landscape is rapidly evolving. New payment rails, central bank digital currencies, and AI-driven financial services are no longer future possibilities but current realities. Organizations that delay modernization risk more than just technical debt – they risk market irrelevance.

Taking Action

Start with a thorough assessment of your current payment infrastructure:- Document integration points and data flows

- Measure actual processing times and costs

- Identify AI/ML implementation barriers

- Calculate the true cost of delayed modernization

Your modernization journey doesn't need to be disruptive. The key is starting with a clear understanding of your current state and a strategic roadmap for evolution.

This post is based on our team's experience implementing payment systems for FinTech companies and financial institutions. Want to discuss your specific modernization challenges? Contact our team of FinTech infrastructure experts.